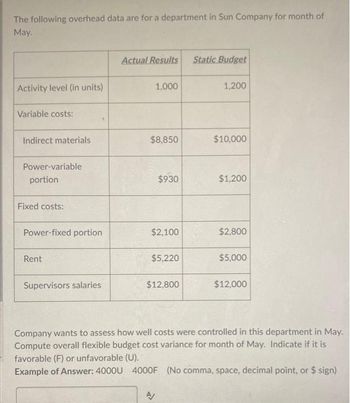

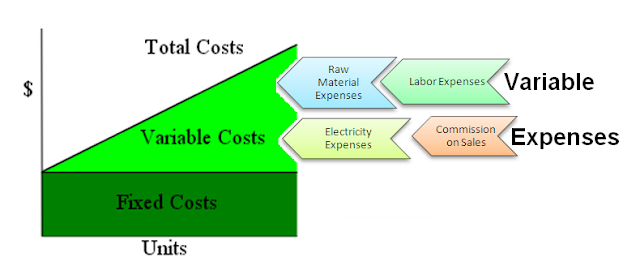

Maximizing profitability comes all the means down to effectively managing both fastened and variable prices. Your enterprise should attempt to maintain its variable value per unit as low as possible with out compromising on quality—this ensures you’re getting as a lot revenue as attainable for every unit sold. Any employees who work on wage count as a fixed value. They earn the same quantity no matter how your corporation is doing. Employees who work per hour, and whose hours change in accordance with business wants, are a variable expense.

Correct classification ensures higher monetary planning, price control, and pricing strategies, contributing to the overall financial well being and competitiveness of a corporation. Another necessary side of variable costs is that they can be each direct and oblique, much like fastened costs. Direct variable costs are bills that might be directly attributed to a particular services or products, similar to the value of raw supplies used in manufacturing a selected item. In conclusion, the value of labor performs a big function within the pricing of services.

Value Structure Administration And Ratios

These are the bottom costs involved in operating a business. As Quickly As established, fixed prices don’t change over the lifetime of an settlement or cost schedule. What is the distinction between the worth of labor and cost of living? While the value of labor pertains to wages paid to workers, the value of dwelling refers to expenses needed for a selected lifestyle in a given location. The value of living may exceed the price of labor, especially in densely populated areas with higher demand for housing, food, and other requirements.

- Nevertheless, one other essential issue to think about is how labor prices differ from price of residing.

- Hourly staff receive the higher of the federal and state minimal wages.

- Mounted costs provide the foundation for operations and ensure the enterprise can continue to function even during times of low sales or production.

- Correct budgeting and cost control measures can help small enterprise homeowners navigate fluctuations in variable costs and keep monetary stability in dynamic market environments.

- Examples of so-called fastened expenses embrace rent, electrical energy and property taxes.

Variable costs will change depending on what quantity of merchandise you purchase or manufacture. For a price to be thought of variable, it needs to differ based on some exercise https://www.simple-accounting.org/ base. Units produced, items sold, direct labor hours and machine hours are all possible activity bases or price drivers in a manufacturing facility.

Nevertheless, figuring out if they are variable or fastened could require some background knowledge. Operating leverage is a price construction metric utilized in cost construction management. Firms can generate extra profit per further unit produced with greater operating leverage. For occasion, somebody who starts a new enterprise would probably begin with fixed bills for rent and administration salaries.

Mounted Costs On Financial Statements

They must consider the financial implications of salary changes, together with the impression on the company’s backside line and the potential for increased worker engagement and productivity. Meanwhile, trade analysts emphasize the significance of benchmarking against opponents to stay enticing to current and potential workers. From an HR standpoint, understanding the function of salaries in price range forecasting is essential for workforce planning. It permits for strategic hiring and expertise administration, guaranteeing that the group can entice and retain the required expertise within its budgetary constraints. For workers, transparency in how their salaries are budgeted can result in higher belief and engagement with the company.

It can even cut back stress related to performance metrics that often include variable pay buildings, such as commissions or bonuses. However, this predictability can also be a double-edged sword. For high performers, a onerous and fast wage might limit the potential for earnings growth, as it doesn’t sometimes account for individual performance past the scope of annual raises or promotions. Moreover, it could not incentivize staff to go above and past in their roles, probably leading to complacency.

Business Performance And Cost Analysis

By ensuring that indirect labor prices are appropriately apportioned to particular products or services, companies can make knowledgeable selections relating to gross sales pricing and manufacturing efficiency. Another important distinction to make is between fixed and variable labor prices. Fastened labor costs, similar to salaries for permanent staff, do not range with production volume; they continue to be the identical regardless of output levels.

However, that assertion assumes that activity ranges will fluctuate. Usually, these embrace gadgets that do not relate to the activity conducted by the corporate. Due To This Fact, these prices don’t change over a specific interval. These should still improve from one period to a different, although. On high of that, different elements may also contribute to this process.

These embody rent, insurance, salaries, and any contracts with fixed payments. On the other hand, variable prices change because the manufacturing output varies. Examples of variable costs embrace uncooked materials, commissions, and utility costs that improve with manufacturing. These fluctuations tie on to the number of units produced, making them more manageable and adjustable depending on the level of activity. Fastened costs are bills that remain constant, regardless of the stage of production or sales quantity, whereas variable costs change in proportion to production or gross sales ranges.

If the enterprise doesn’t produce any shoes for the month, it nonetheless has to pay $7,500 for the cost of renting the machine. Similarly, if the enterprise produces 10,000 mugs, the value of renting the machine stays the same. Fastened prices sometimes keep the same for a selected period and they are usually time-related. Variable costs, nonetheless, do not stay the same and are often immediately linked to enterprise activities.